Investigating a personal injury claim or case can be a complicated process; it requires a thorough understanding of the parties and business involved, projection of earnings or profits if there is a business and many other factors. This may all sound complicated (and in most situations it is!) but an experienced expert accountant will have no difficulty investigating these matters and presenting them in a logical way, by using simple language that can be understood by the informed layman i.e. lawyers and judges.

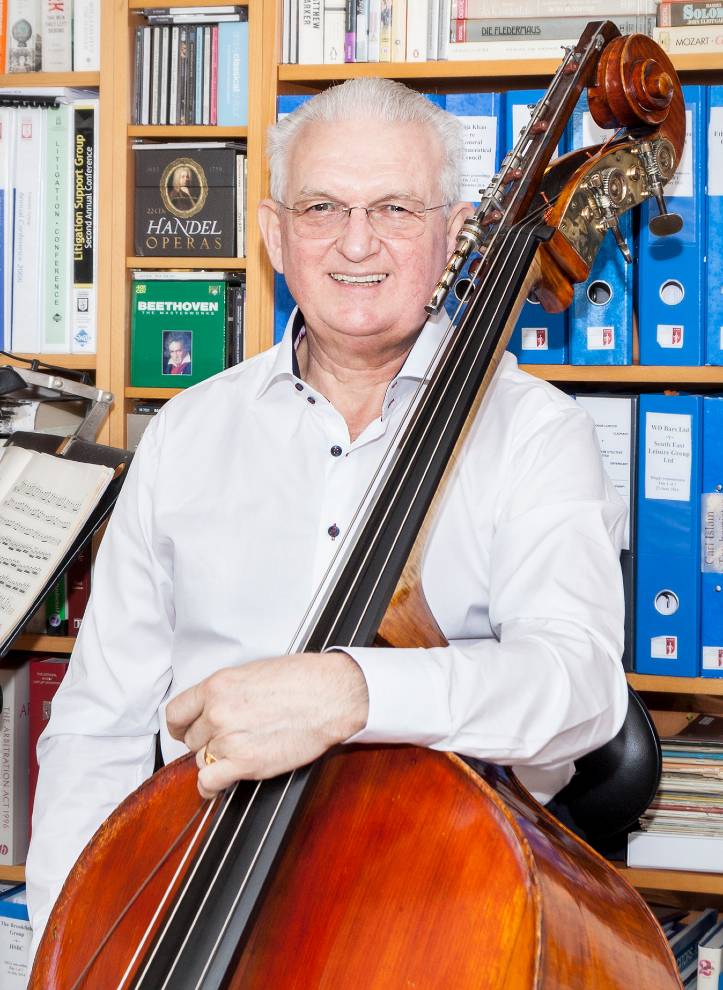

Chris has acted as a forensic accountant in scores of personal injury cases over the last 30 years, for claimants and dependants, and for defendant insurers and claims managers. He has given expert evidence on personal injury cases at least 25 times and has found it particularly rewarding meeting the family dependants of fatal accidents including mesothelioma.

Chris’s experience is best illustrated by the fact that for many years, up to the death of David Kemp QC, he contributed two chapters to the Kemp & Kemp seminal work “The Quantum of Damages”. His chapter on quantification of loss of income for the self-employed and family company director is particularly apposite. This, now out of print, is available free on request.

Chris is rated as a 1st class expert by APIL.

Chris offers an initial review of your personal injury case with no obligation, so you can find out more about the value that he can add to your case before you commit to instruct him. This is without charge on all but the largest cases. If he feels his involvement is not needed in your particular case, he’ll let you know. So it costs you nothing to find out if Chris can help.

It matters not to Chris whether someone has been knocked down by a motor vehicle or suffered from a careless surgeon’s knife; if that person has had a personal injury or suffered from clinical negligence so that they can’t work again, or they have reduced earning capacity, he works out (in a report to be presented to the court) how much, in his opinion, that person would have earned but for their injuries.

For fatal accidents, the process is the same except that, once he has established how much the deceased would have earned for the rest of his life, he can work out what his living expenses would have been, or whether the conventional proportion under Harris -v- Empress Motors [1983] 3 All ER 561 should apply.

There are many complicated questions that come up during a personal injury claim and so it is important to have a specialist on board who can provide the answers and a comprehensive report to allow the court to make a clear decision.

Personal injury, clinical negligence and fatal accident claims are just some of many cases that Chris has had experience with.

For an example of his unconventional but effective approach, see the personal injury case study: The Human Dynamo – “Buy Him a Man”

The first issue to consider is whether the claimant is (or was) employed or self-employed (including as a director of a family company).

If the claimant was employed, quantification of the claim may be simple and may not need the help of a forensic accountant. Do NOT fall into the trap of taking the last three months’ payslips and assume that earnings would have continued at the same level. Remember that net pay is calculated on an annual basis. Take the P60s for the last three years to see if the earnings were consistent. If not, why not? Promotion? Varying overtime? Seasonal variations (farmhands for example)? If the answer is not obvious, seek help. And ask if there is a need to quantify future earnings where promotion is expected – in the armed forces, for example.

For the self-employed, particularly now that Kemp & Kemp is not helpful, a forensic accountant’s help will be needed. Speak to Chris, and ask him to perform an initial review without obligation, and without charge if not appointed – see. He will tell you if his help is not needed, or the approximate fee if he can add value to your claim.

Forensic accountants play a crucial role in personal injury cases where the financial impact extends beyond lost wages or medical expenses. Chris’s expertise is particularly valuable in cases involving:

Self-employed individuals: Forensic accountants can accurately assess the loss of earnings for self-employed individuals, considering factors such as pre-accident income patterns, business growth projections, and the impact of the injury on the individual’s ability to manage their business.

Business owners: For business owners, forensic accountants can evaluate the overall financial impact of the accident on the business entity. This includes analysing lost profits, potential business interruption damages, and the impact of the owner’s injury on the business’s operations.

Loss of earnings for businesses: In cases where the accident results in a loss of earnings for the business itself, forensic accountants can quantify the financial damages incurred. This may involve analysing sales trends, expense patterns, and the impact of the accident on the business’s ability to operate efficiently, particularly if the injured person was a rainmaker.

Forensic accountants are also often engaged in cases where the accident resulted in death or the inability to continue in the same occupation post-accident. In these cases, they can assist in calculating the loss of future earnings potential, as well as the costs associated with vocational rehabilitation or retraining.

The involvement of a forensic accountant in personal injury cases can significantly strengthen the claimant’s position, ensuring that the full extent of their financial losses is accurately assessed and accounted for.

Chris has worked on a variety of personal injury cases, which you can read about in the case studies section.

Chris is able to assist on cases of varying types and values, including:

Speak to Christo see how he can assist your case.

Every case is different. For the initial review, Chris would need to see the annual accounts of the business for the last three years and to have a brief description of the business and how the claimant’s injuries (or death) will have affected its profitability.

Thereafter, it depends on what is available: competitors, market size and market share, limiting factors, online marketing, working capital… the list goes on. Business plans and management accounts may help. Particularly challenging is the business which has just started where it may be possible to quantify losses purely from a business plan.

A comprehensive assessment of lost earnings should consider the following:

For many years Chris had a chapter in Kemp & Kemp The Quantum of Damages, entitled “Loss of Earnings by the Self-Employed”. On the death of David Kemp QC a new editorial board was appointed by Sweet & Maxwell, and his work was subsumed in the work of others, though in a superficial way. Kemp & Kemp no longer provides a useful guide to quantifying loss of earnings by the self-employed and the director of a family business. Chris’s chapter, though out of print, is available on request without charge; simply put in a request on the Contact page.

Chris possesses the expertise to evaluate thoroughly the profit/loss of income for business owners and self-employed claimants. His assessments encompass a comprehensive analysis of trading history, growth patterns, and the impact on income streams and expense patterns. Chris meticulously reviews all available profit and loss accounts information, ensuring that his conclusions are well-grounded and accurate. And that they can be understood, even by lawyers!

Pension rights cases are often intricate and challenging to navigate. Chris’s expertise extends to assisting individuals and entities in all types of pension rights loss cases. He provides detailed reviews and reports that meticulously analyse the intricacies of each case, ensuring that clients receive comprehensive and well-informed guidance.

In the unfortunate event of an accident resulting in a fatality, Chris provides expert assistance in calculating the accurate percentage of dependency for surviving family members, in the minority of claims where Harris -v- Empress Motors [1984] 1 WLR 212 does not apply. He deftly navigates the complexities of dependency claims, ensuring that the financial impact on the deceased’s dependents is accurately assessed and accounted for. Remember the Selby rail crash between a goods train and the Newcastle to Kings Cross Express? Chris acted for the families of five high-earners in First Class who lost their lives on that fateful day.

Injured individuals making a personal injury claim must mitigate, that is, take reasonable steps to reduce the losses claimed for. The following questions will establish the magnitude of the impairment:

Earnings should be adjusted downwards to account for costs that are no longer incurred by the injured party. These might include:

With personal injury claims, which may be overlooked include:

Losses in personal injury claims can be categorised as the following:

General damages are awarded based on the injury suffered, the duration of any symptoms and the impact these have had or will have. The courts will refer to the Judicial College Guidelines for the assessment of General Damages in Personal Injury Cases (On these, Kemp & Kemp is excellent!). These guidelines set out award brackets for common injuries, including awards for previous similar cases, inflation-adjusted.

Due to the differing nature of injuries and their impacts on individuals, these guidelines provide a starting point. General Damages are intended to compensate the injured individual for PSLA (Pain, Suffering and Loss of Amenity). General Damages are dealt with by lawyers.

Special Damages are financial losses incurred by the injured party as a direct result of the accident. They may include:

Past Damages are those that have been accrued from the date of the accident until the date of the trial or settlement. They are called Special because they can be calculated accurately.

Future Damages are losses that will be incurred by the injured party after the expected trial date or settlement. Expert evidence will determine the extent of the damages, looking at any ongoing needs the claimant may require, including any future treatments.

Where the life expectancy of the injured party has been reduced, future losses will be limited by this reduction. The Ogden Tables are invaluable in this scenario.

The evidence will need to show what is required, when it is required and for how long so that calculations can be prepared. These complex calculations are often a contentious point between the parties.