Companies House Searches Are USELESS!

Some time ago, I had to write an article explaining that in matrimonial cases it is not possible for me to investigate a party’s financial affairs and present my findings to the court unless I were to act as a Single Joint Expert and that it would be most unlikely that a wife (typically) could persuade her husband (typically) that I should act as his expert as well as hers.

I had to give that explanation so many times to ladies (“I want you to go in there and find out exactly what that [deleted] is doing with all his money”) that when I received three such requests in one morning I decided something had to be done. So I wrote a blog explaining the situation, and I now direct the caller to that blog and ask them to ring back if they think I can still do anything. They never do.

I regret there is a similar problem with accounts obtained from searches at Companies House. A solicitor, say in a divorce case, does a search from Companies House, sends those accounts to me, and expects me to do a company valuation.

Well, I’m sorry, but this is just not possible.

A good 90% of limited companies are micro companies, and the information they have to file is very sparse. To qualify as a micro company, it must fall below a turnover of £632k, a balance sheet total of £316k and fewer than 10 employees. The company has to breach two of those limits to lose its status as a micro company. And in April 2025 it will be even higher: turnover £1million, balance sheet total £500k and employees 10.

The vast majority of companies I come across in matrimonial cases are micro companies; obviously, since it is a small family company which will have to be valued for clean break purposes.

The advantage of being a micro company is that one has to file very little information on public record at Companies House. And it is surprising what little information we can see.

Typically, the accounts on public file will comprise a front sheet with the name of the company, a sheet showing addresses, directors’ names, sometimes accountants and bankers, then the balance sheet, and then a couple of notes giving such details as accounting policies (standard stuff), fixed assets, analysis of creditors… And that’s it.

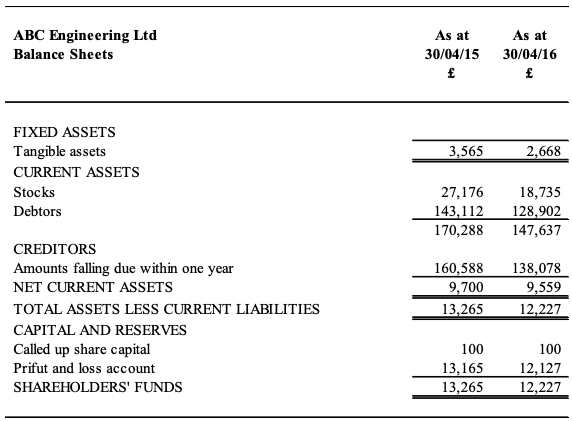

From an old case I worked on some time ago, which of course I have anonymised, the balance sheet from Companies House looks like this:

What is its turnover? Its prime cost? Its overheads, including anything suspicious? Directors’ salaries? Dividends? Tax charged? I have no idea. Yet these are the details I need to be able even to start a company valuation.

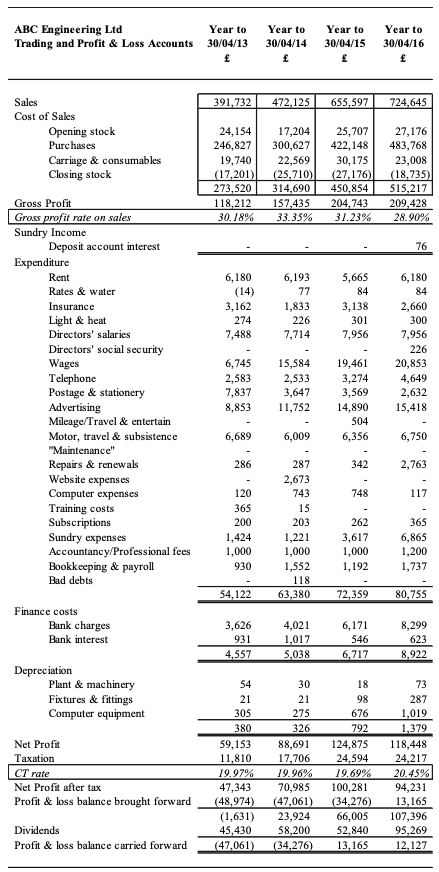

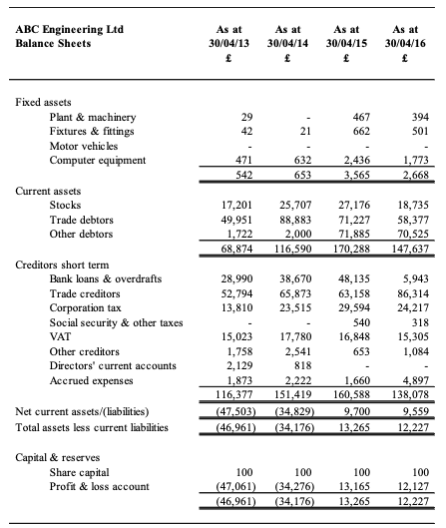

When I receive copies of the detailed accounts from the directors (and these full accounts must exist), I always summarise them to see the above details and to plot trends etc. The difference in what I learn from these detailed accounts is remarkable. Look at this, compared with the sparse figures above:

Moral: don’t waste everyone’s time by sending Companies House accounts to me as if they will tell me all I need to know. They won’t; they are useless.